Table of Contents

- Inflation perceptions and expectations

- Economic outlook - Budget 2024 - 30 May 2024

- US flash PMI signals steep fall in inflation at start of 2024 | S&P ...

- February 2024 CPI Inflation Report Predictions | Seeking Alpha

- Economic Bulletin Issue 3, 2024

- ‘Inflation to remain low until 2026’ | Philstar.com

- Inflation perceptions and expectations

- Wall Street doomsayers predict 'mild' US recession in 2024 | Daily Mail ...

- Continuum Economics

- Us Cpi Data June 2024 Usa - Dido Chelsie

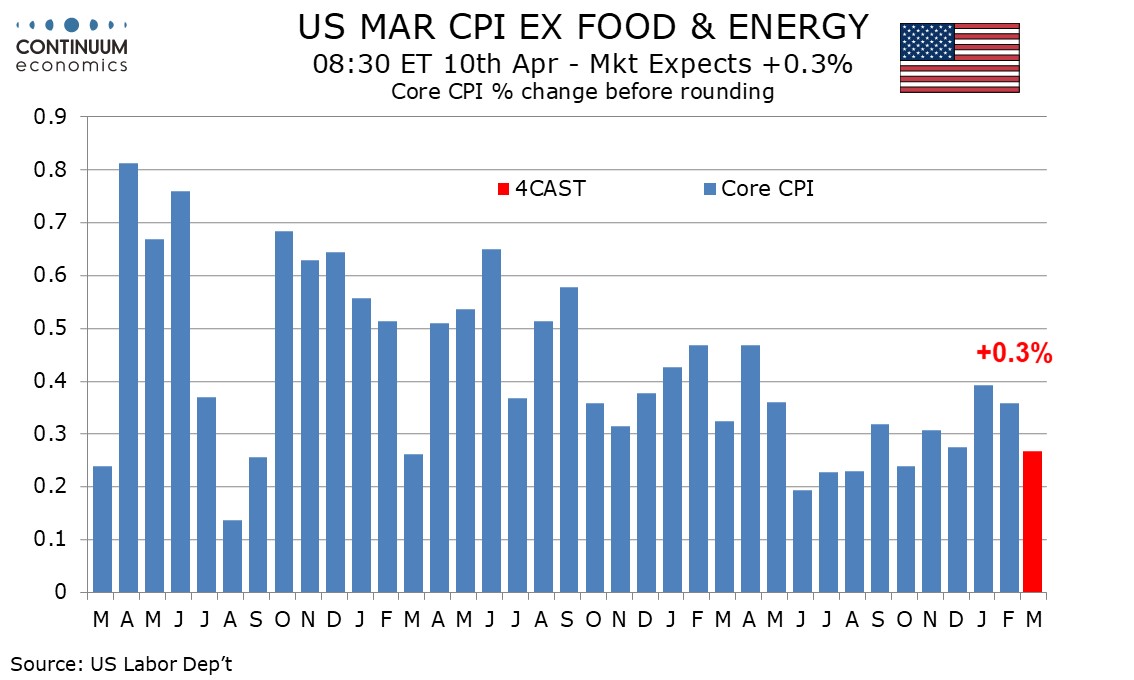

Understanding the intricacies of inflation is crucial for making informed financial decisions, whether you're a savvy investor, a budget-conscious consumer, or a business owner looking to stay ahead of the curve. One of the most valuable tools in deciphering inflation trends is the Consumer Price Index (CPI), which has been tracking US inflation data since 1913. In this article, we'll delve into the world of CPI data, exploring its significance, historical trends, and how to leverage a US inflation calculator to make sense of it all.

What is the Consumer Price Index (CPI)?

The Consumer Price Index is a statistical measure that calculates the average change in prices of a basket of goods and services consumed by households. The CPI is widely regarded as a key indicator of inflation, which is the rate at which prices for goods and services are rising. The US Bureau of Labor Statistics (BLS) is responsible for compiling and publishing CPI data, which is released monthly.

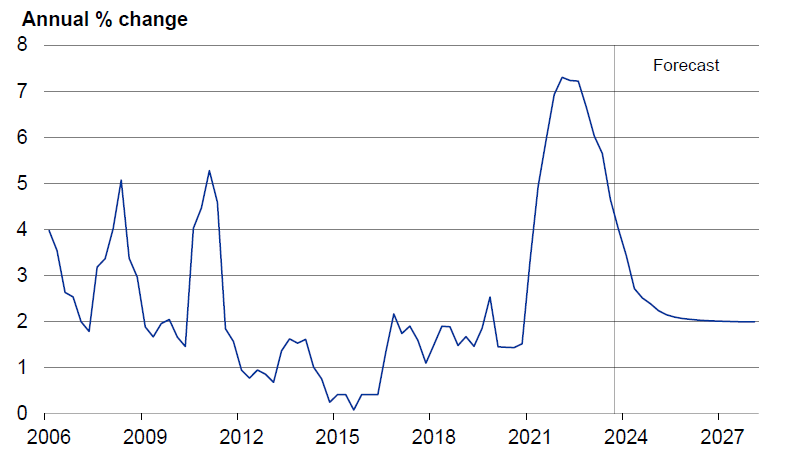

Historical CPI Data: 1913 to 2025

With over a century's worth of data, the CPI has witnessed significant economic events, including the Great Depression, World War II, and the 2008 financial crisis. Analyzing historical CPI data provides valuable insights into the US economy's performance over time. From 1913 to 2025, the CPI has undergone numerous revisions, with the BLS continually updating the basket of goods and services to reflect changes in consumer spending habits.

US Inflation Calculator: A Powerful Tool for Financial Planning

A US inflation calculator is an indispensable resource for anyone looking to understand the impact of inflation on their finances. By inputting a specific amount and date range, users can calculate the equivalent value of that amount in today's dollars, taking into account the effects of inflation. This tool is particularly useful for:

- Calculating the future value of savings or investments

- Assessing the impact of inflation on retirement planning

- Comparing the purchasing power of different time periods

- Informing business decisions, such as pricing strategies and cost forecasting

Key Takeaways and Insights

By examining CPI data from 1913 to 2025 and utilizing a US inflation calculator, several key takeaways emerge:

- Inflation has averaged around 3% per annum over the past century, with significant fluctuations during times of economic turmoil

- The purchasing power of the US dollar has decreased substantially over time, with $1 in 1913 equivalent to approximately $25 in 2023

- Understanding inflation trends is crucial for making informed financial decisions, from saving and investing to budgeting and planning for the future

In conclusion, the Consumer Price Index is a vital tool for understanding US inflation trends, and a US inflation calculator is an essential resource for anyone looking to make sense of CPI data. By exploring historical trends and leveraging the power of inflation insights, individuals and businesses can make more informed financial decisions, navigate economic uncertainty, and build a stronger financial future.

Stay ahead of the curve by exploring CPI data from 1913 to 2025 and utilizing a US inflation calculator to unlock the full potential of your financial planning. Whether you're a seasoned investor or just starting to build your financial foundation, the power of inflation insights is at your fingertips.