As one of the largest healthcare companies in the world, UnitedHealth Group (UNH) has been a stalwart in the industry, providing a wide range of healthcare services and products to millions of people. With its stock price consistently performing well, investors are keen to know more about the company's prospects and potential for growth. In this article, we will delve into the world of UnitedHealth Group, analyzing its stock price, financials, and market trends to provide a comprehensive overview of this healthcare giant.

Company Overview

UnitedHealth Group is a diversified healthcare company that operates through two main business segments: UnitedHealthcare and Optum. UnitedHealthcare is the largest health insurer in the United States, providing a range of health insurance products and services to individuals, employers, and government agencies. Optum, on the other hand, is a leading provider of health information technology and services, including data analytics, pharmacy benefit management, and healthcare consulting.

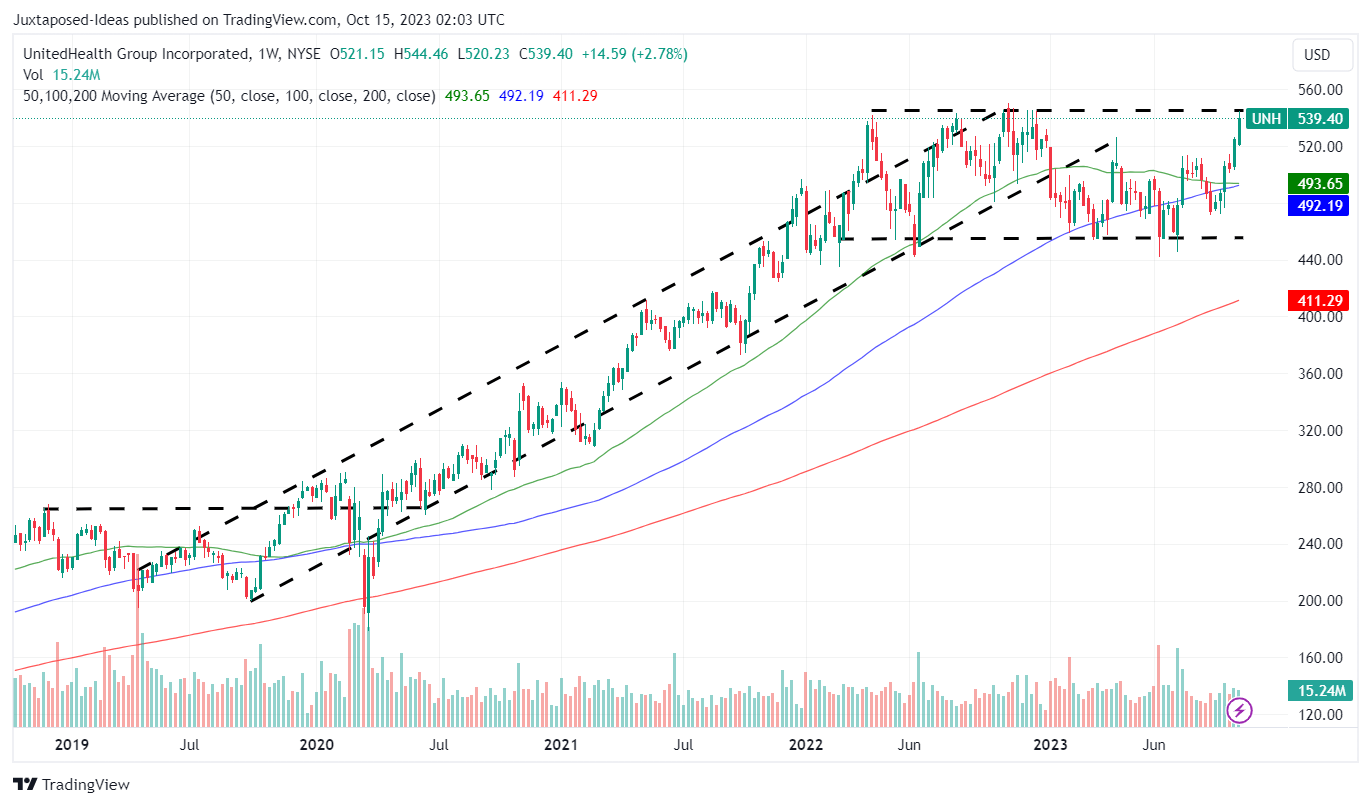

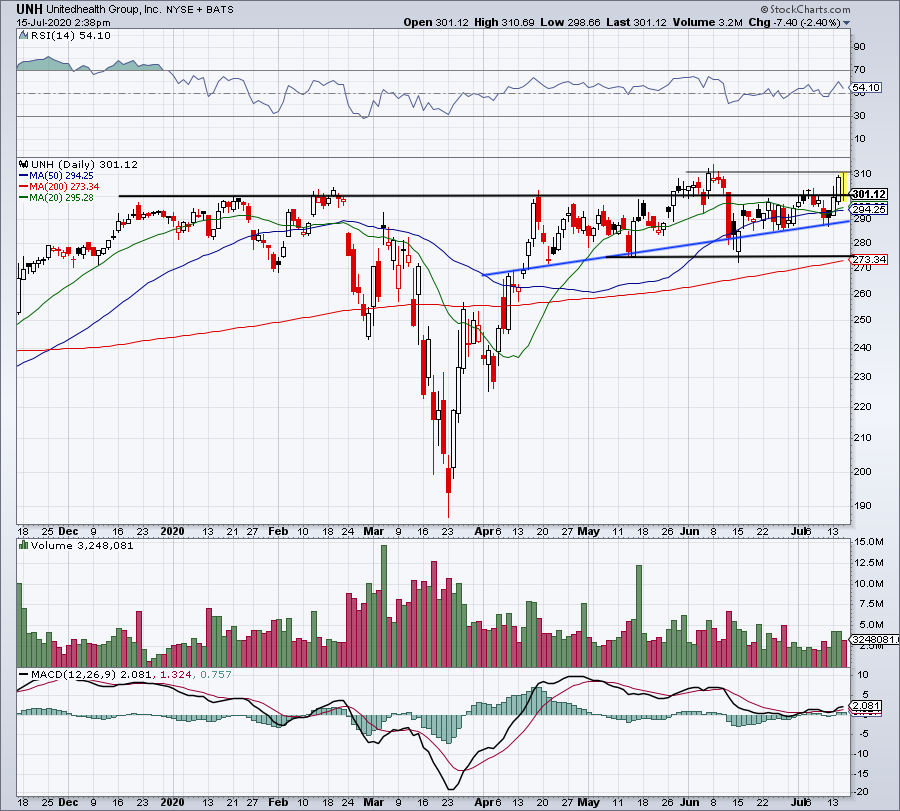

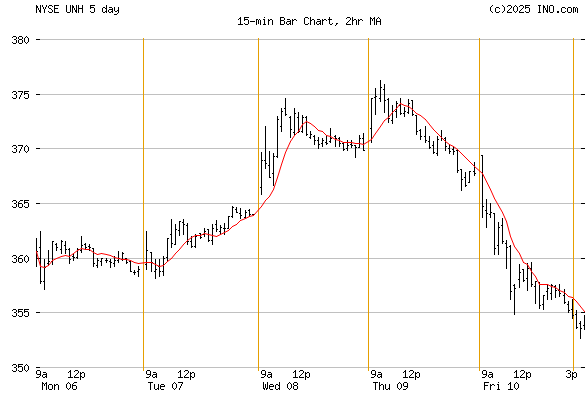

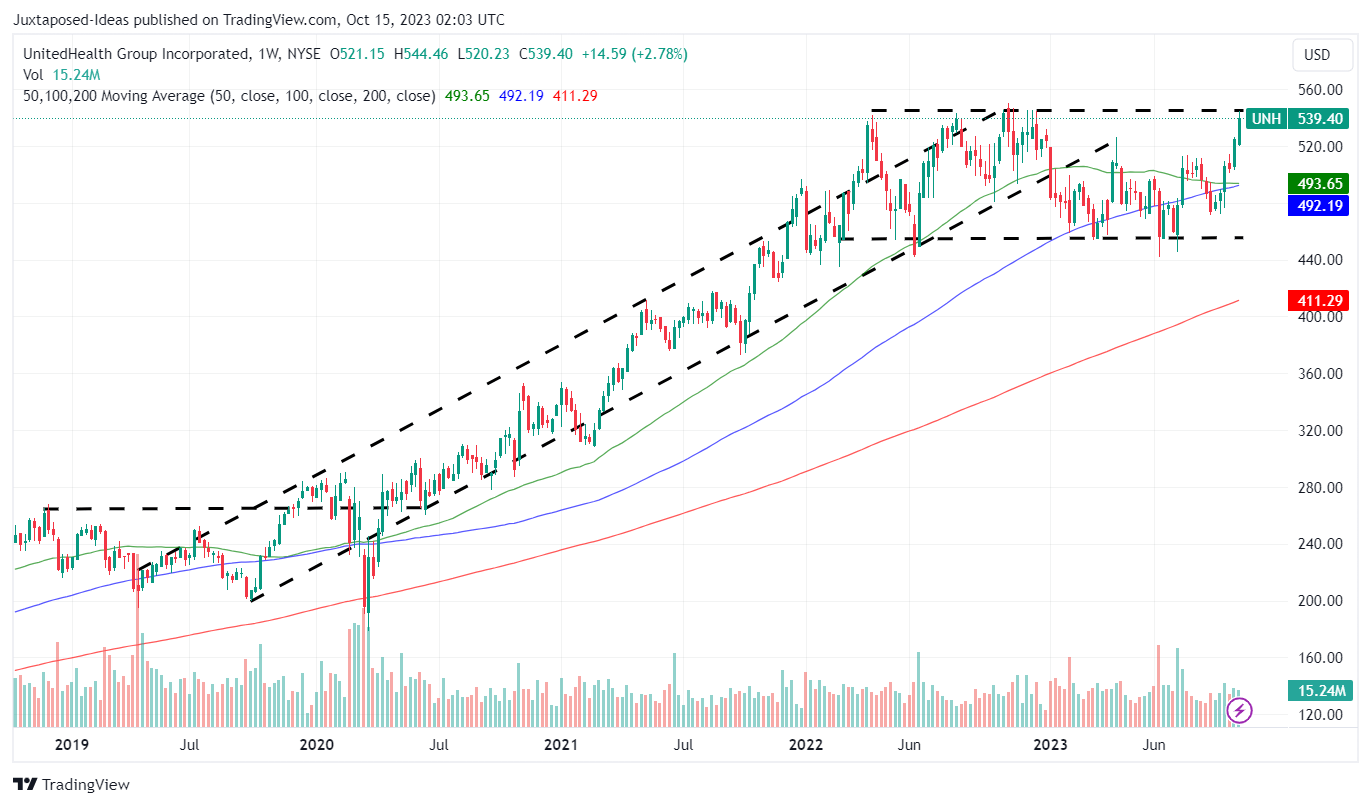

Stock Price Analysis

The stock price of UnitedHealth Group (UNH) has been on an upward trend over the past few years, with a significant increase in value. As of the latest trading session, the stock price of UNH is around $400, with a market capitalization of over $380 billion. The stock has a beta of 0.73, indicating a relatively low volatility compared to the overall market.

In terms of stock performance, UNH has consistently outperformed the S&P 500 index over the past five years, with an average annual return of 15%. The stock has also shown a strong dividend yield, with a current dividend payout of 1.4%. This makes it an attractive option for income-seeking investors.

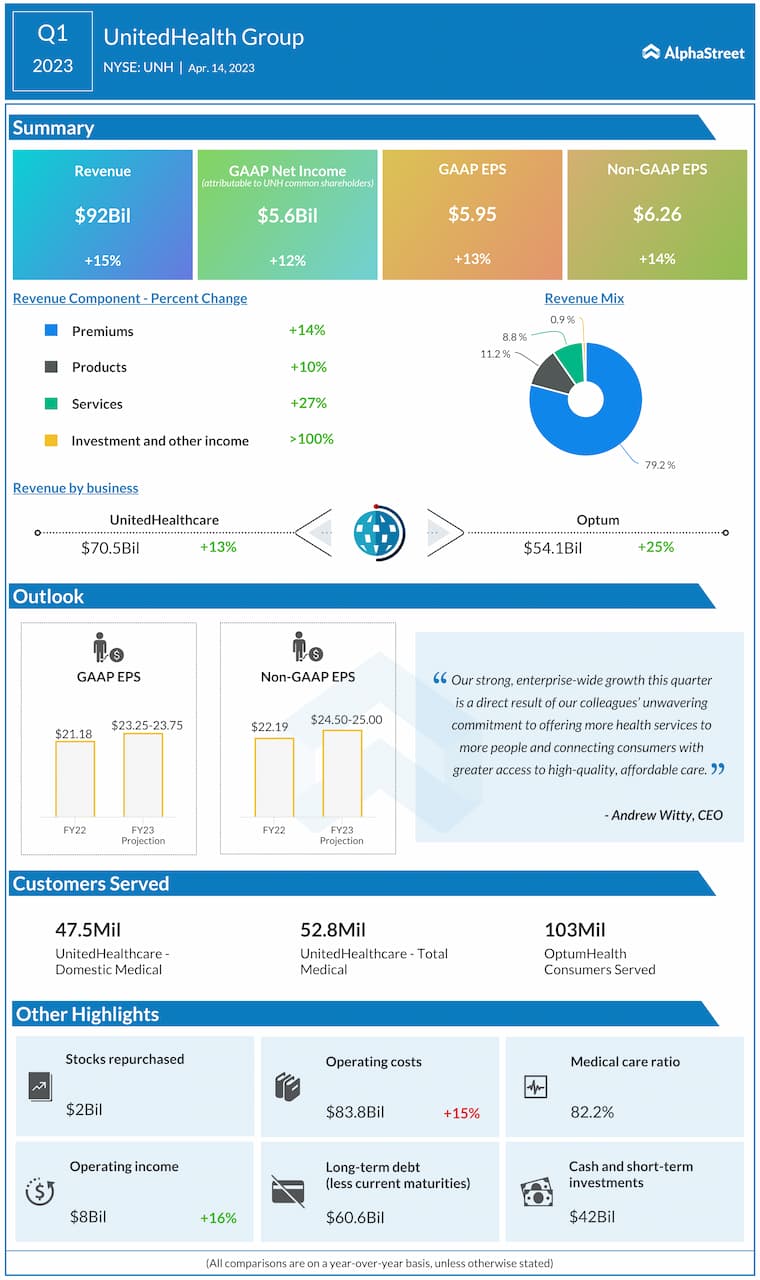

Financial Analysis

UnitedHealth Group's financials have been impressive, with a steady increase in revenue and earnings over the past few years. In 2022, the company reported revenues of $285 billion, with a net income of $15.4 billion. The company's operating margin has also been expanding, reaching 7.3% in 2022.

The company's balance sheet is also strong, with a debt-to-equity ratio of 0.63 and a current ratio of 0.74. This indicates that the company has a healthy financial position, with a strong ability to meet its short-term obligations.

Market Trends and Outlook

The healthcare industry is expected to continue growing, driven by an aging population and an increased focus on healthcare technology. UnitedHealth Group is well-positioned to benefit from these trends, with its diversified business model and strong market position.

However, the company also faces challenges, including increased competition and regulatory uncertainty. The COVID-19 pandemic has also had a significant impact on the healthcare industry, with increased costs and reduced revenues.

Despite these challenges, analysts are optimistic about the company's prospects, with a consensus rating of "buy" and a target price of $450. The company's strong financials, diversified business model, and growth prospects make it an attractive option for investors.

In conclusion, UnitedHealth Group (UNH) is a strong performer in the healthcare industry, with a consistent track record of growth and a diversified business model. The company's stock price has been on an upward trend, with a strong dividend yield and a relatively low volatility. While the company faces challenges, its financials and market position make it an attractive option for investors. As the healthcare industry continues to evolve, UnitedHealth Group is well-positioned to benefit from emerging trends and growth opportunities.

With its strong fundamentals and growth prospects, UnitedHealth Group (UNH) is a stock worth considering for investors looking to gain exposure to the healthcare industry. Whether you're a seasoned investor or just starting out, UNH is definitely a stock to watch in the coming months and years.