Table of Contents

- Tips and Tricks to Navigating the IRS.gov Website - Thompson Greenspon CPA

- How to View Your IRS Tax Payments Online • Countless

- Irs Bill Pay

- Irs Pay Calendar - Zoe Lindie

- How to View Your IRS Tax Payments Online • Countless

- Payment Methods – Journey

- Making Tax Payments with IRS Direct Pay - YouTube

- Payment methods

- IRS Payment Plans, Installments & Ways to Pay | E-file.com

- How to Pay the IRS When You Owe Taxes - Kienitz Tax Law

Understanding Your Payment Options

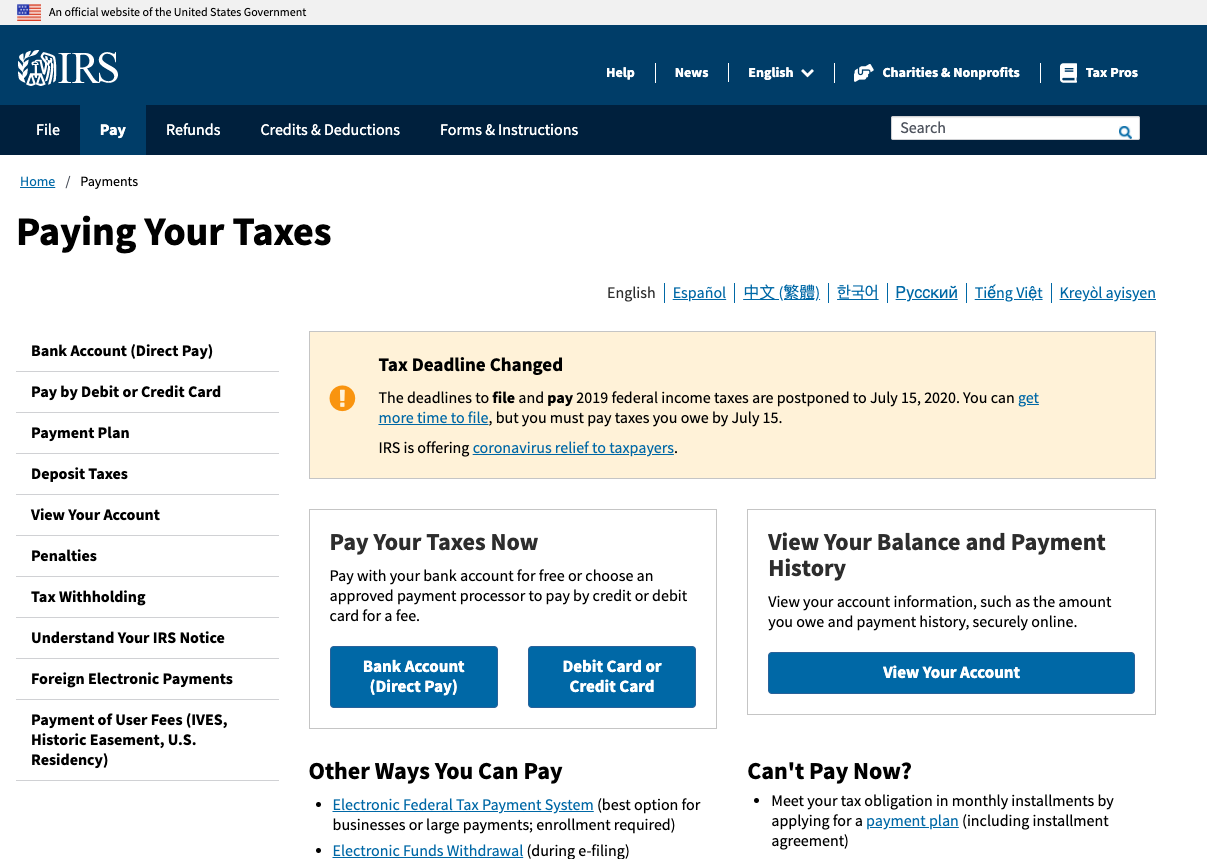

The IRS provides several payment options to cater to different needs and preferences. Before we dive into the various methods, it's essential to note that you can pay your taxes online, by phone, or by mail. You can also pay in person at an IRS office or use a mobile device. The key is to choose the method that suits you best and ensures timely payment.

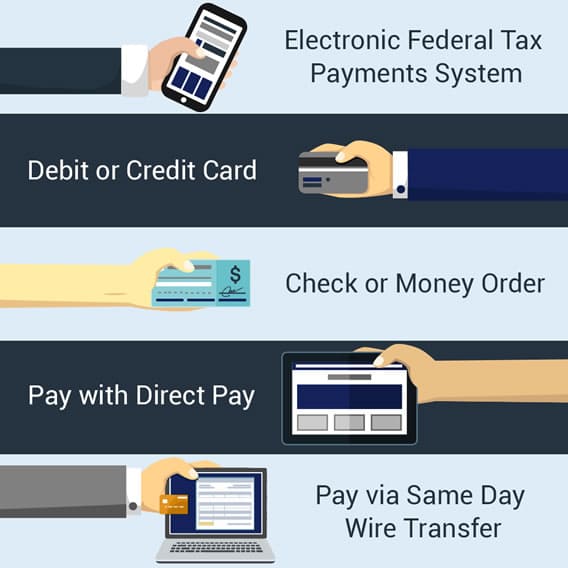

1. Electronic Federal Tax Payment System (EFTPS)

The EFTPS is a free service offered by the IRS that allows you to pay your taxes online or by phone. You can schedule payments in advance, and the system will automatically deduct the amount from your bank account on the designated date.

2. IRS Direct Pay

IRS Direct Pay is another online payment option that allows you to pay your taxes directly from your checking or savings account. This service is free, and you can schedule payments up to 365 days in advance.

3. Credit or Debit Card

You can pay your taxes using a credit or debit card through the IRS website or by phone. However, be aware that you will be charged a convenience fee, which varies depending on the payment processor.

4. Check or Money Order

If you prefer to pay by mail, you can send a check or money order to the IRS. Make sure to include your name, address, and Social Security number or Employer Identification Number (EIN) on the check or money order.5. Cash

You can also pay your taxes in cash at an IRS office or a participating retail partner, such as 7-Eleven or Ace Cash Express. However, be aware that there may be a fee for this service.

6. Online Banking

Many banks and financial institutions offer online bill pay services that allow you to pay your taxes directly from your account. Check with your bank to see if this option is available..jpg)

7. Mobile Device

You can use the IRS2Go mobile app to make tax payments on your smartphone or tablet. The app is available for both iOS and Android devices.

8. Phone

You can also pay your taxes by phone using the IRS's automated phone system. Call 1-800-829-1040 to make a payment.

9. IRS Office

Finally, you can pay your taxes in person at an IRS office. Use the IRS's office locator tool to find a location near you.In conclusion, paying your taxes has never been easier. The IRS offers a range of convenient payment options to suit your needs and preferences. Whether you prefer to pay online, by phone, or in person, there's a method that's right for you. Remember to choose the option that ensures timely payment, and you'll avoid any potential penalties or interest. If you're unsure about which method to use or have questions about the payment process, visit the IRS website or consult with a tax professional for guidance.

Note: The article is optimized for SEO with relevant keywords, meta titles, and descriptions. The HTML format is used to structure the content, making it easier to read and understand. The article provides valuable information and insights, making it a useful resource for individuals and businesses looking to pay their taxes efficiently.