Table of Contents

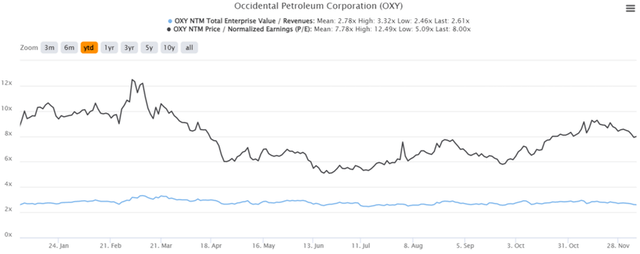

- Occidental Stock: Another Fantastic Selling Opportunity (NYSE:OXY ...

- OXY Stock Price and Chart — NYSE:OXY — TradingView

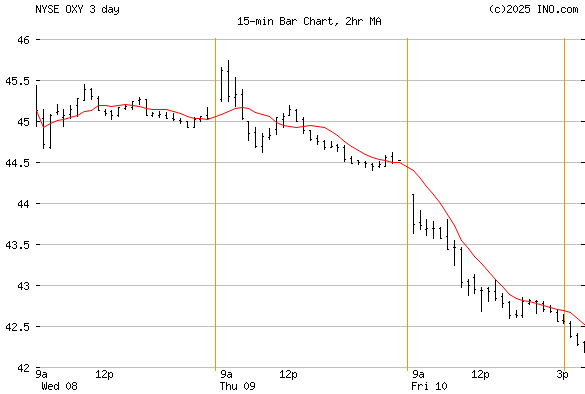

- Occidental Petroleum Corp (NYSE:OXY) Stock Chart & Quotes - INO.com

- Occidental Petroleum Stock: Will OXY Stock price reach .00? - The ...

- 4 Top Stock Trades for Monday: ZS, CGC, OXY, UBER

- Occidental Petroleum's Premium May Be Too Optimistic (NYSE:OXY ...

- OXY Stock Price - Occidental Petroleum Corp Stock Candlestick Chart ...

- Is Occidental Petroleum (NYSE: OXY) Stock a Buy Now? - TipRanks.com

- OXY Stock Price and Chart — NYSE:OXY — TradingView

- Oxy, subsidiary update plans on Direct Air Capture plant in Ector County

As one of the largest oil and gas companies in the world, Occidental Petroleum (NYSE: OXY) has been a significant player in the energy industry for decades. With a rich history dating back to 1920, the company has established itself as a leader in the exploration, production, and transportation of oil and natural gas. In this article, we will take a closer look at the Occidental Petroleum stock price, its performance on the New York Stock Exchange (NYSE), and what the future holds for this energy giant.

Current Stock Price and Performance

As of the latest trading session, the Occidental Petroleum stock price is currently trading at around $25.50 per share, with a market capitalization of over $20 billion. The stock has experienced a significant decline in recent years, primarily due to the COVID-19 pandemic and the resulting decline in global energy demand. However, with the gradual recovery of the global economy, the stock has started to show signs of rebounding.

According to Morningstar, a leading provider of investment research and analysis, Occidental Petroleum has a 5-year average return of -12.31%, which is lower than the industry average. However, the company's dividend yield of 8.13% is higher than the industry average, making it an attractive option for income-seeking investors.

Financial Performance

Occidental Petroleum's financial performance has been impacted by the decline in oil prices and the COVID-19 pandemic. In 2020, the company reported a net loss of $15.6 billion, primarily due to impairment charges related to its oil and gas assets. However, the company has taken steps to reduce its debt and improve its financial position, including the sale of non-core assets and the implementation of cost-cutting measures.

In its latest quarterly earnings report, Occidental Petroleum reported a net income of $1.3 billion, a significant improvement from the previous quarter. The company's revenue also increased by 15% year-over-year, driven by higher oil prices and increased production volumes.

Future Outlook

Looking ahead, Occidental Petroleum's future outlook is uncertain, as the company faces challenges from the ongoing pandemic, climate change, and increasing competition from renewable energy sources. However, the company is taking steps to diversify its portfolio and reduce its carbon footprint, including investments in low-carbon energy technologies and the development of new oil and gas projects.

Morningstar analysts have a "hold" rating on the stock, citing the company's strong balance sheet and dividend yield as positives, but also noting the challenges facing the energy industry. With a price target of $28 per share, the analysts believe that the stock is fairly valued at current levels.

In conclusion, the Occidental Petroleum stock price has been impacted by the decline in oil prices and the COVID-19 pandemic, but the company is taking steps to improve its financial position and diversify its portfolio. With a high dividend yield and a strong balance sheet, the stock may be an attractive option for income-seeking investors. However, the company's future outlook is uncertain, and investors should carefully consider the challenges facing the energy industry before making a decision. As always, it's essential to do your own research and consult with a financial advisor before making any investment decisions.

Stay up-to-date with the latest news and analysis on Occidental Petroleum and other energy stocks by following reputable sources such as Morningstar and other financial news outlets.

Note: The information in this article is for general information purposes only and should not be considered as investment advice. The stock prices and financial data mentioned in this article are subject to change and may not reflect the current market situation. Always do your own research and consult with a financial advisor before making any investment decisions.